In today’s fast-paced world, managing your finances effectively is crucial. With a plethora of money management, investment tracking, and budgeting apps available, choosing the right one can be overwhelming. This article aims to provide an in-depth comparison of three prominent platforms—Personal Capital, Quicken, and Kubera—to help you make an informed decision tailored to your financial needs.

Let the Breakdown Begin: Quicken, Personal Capital, and More

Are you ready to build a diverse investment portfolio, consider white-glove wealth management services, set achievable savings goals, and otherwise improve your financial life? Then get ready to dive into this comprehensive analysis. By the time you finish reading this article, you’ll have the essential information required to select the optimal solutions for your unique financial situation.

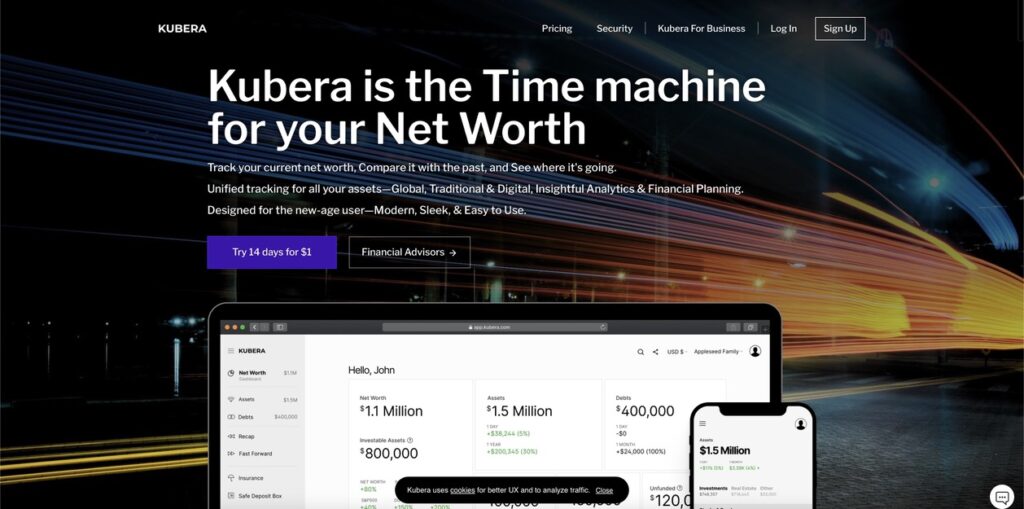

Kubera: Asset and Investment Tracking for Modern, Diverse Investors

Kubera is designed to cater to the needs of modern, diverse investors seeking efficient asset and investment tracking tools. As you navigate through the features and capabilities of Kubera, you’ll gain insights into how this platform can elevate your investment management experience.

About Kubera

If you’ve been tirelessly searching for the perfect portfolio tracker, Kubera offers a robust solution that goes beyond mere account management. It empowers users to build a diversified portfolio strategy, ensuring stability and growth even in challenging market conditions.

Kubera stands out with its user-friendly interface, providing a seamless experience for investors of all levels. The platform’s emphasis on modern investment practices makes it an ideal choice for those seeking a comprehensive tracking tool.

| Key Features of Kubera |

|---|

| – Portfolio Diversification Strategy |

| – User-Friendly Interface |

| – Modern Investment Practices |

Try Kubera Today

Ready to experience the benefits of Kubera firsthand? Sign up today and take control of your investment journey with a platform designed to meet the demands of modern investors.

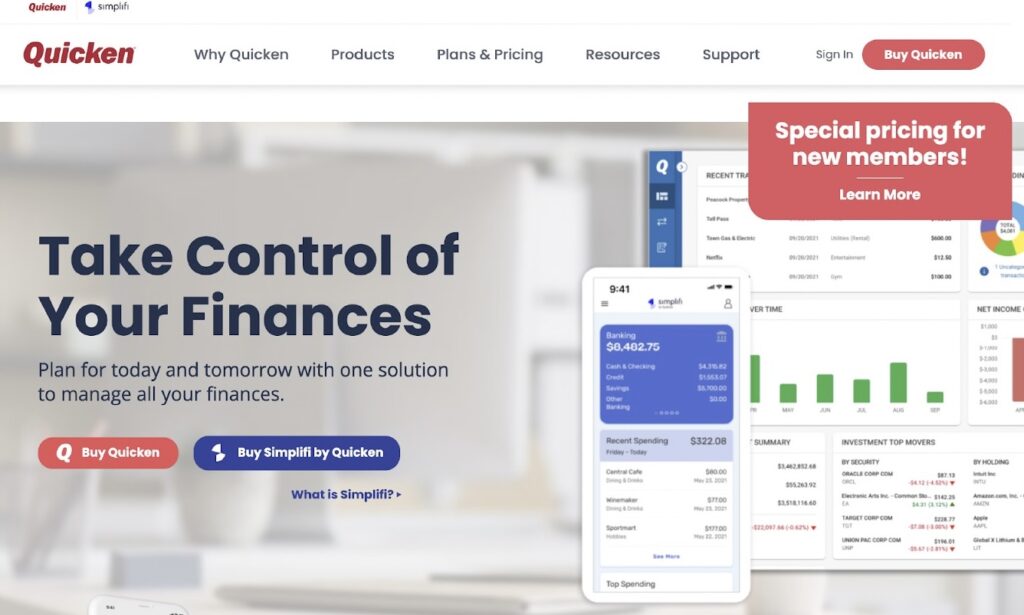

Quicken: Budgeting, Bill Pay, and Business Management Dashboard

Quicken is renowned for its multifaceted approach, offering features such as budgeting, bill pay, and a business management dashboard. Delve into the details of Quicken to understand how it can streamline your financial activities and enhance your overall money management experience.

About Quicken

Quicken’s comprehensive suite of tools provides users with a holistic view of their financial landscape, enabling them to efficiently manage budgets, track expenses, and stay on top of bills. The platform’s business management dashboard further caters to the needs of entrepreneurs and small business owners, offering valuable insights and analytics.

| Key Features of Quicken |

|---|

| – Budgeting Tools |

| – Bill Payment Integration |

| – Business Management Dashboard |

Explore Quicken’s array of features and take charge of your financial well-being with a platform designed to simplify money management tasks.

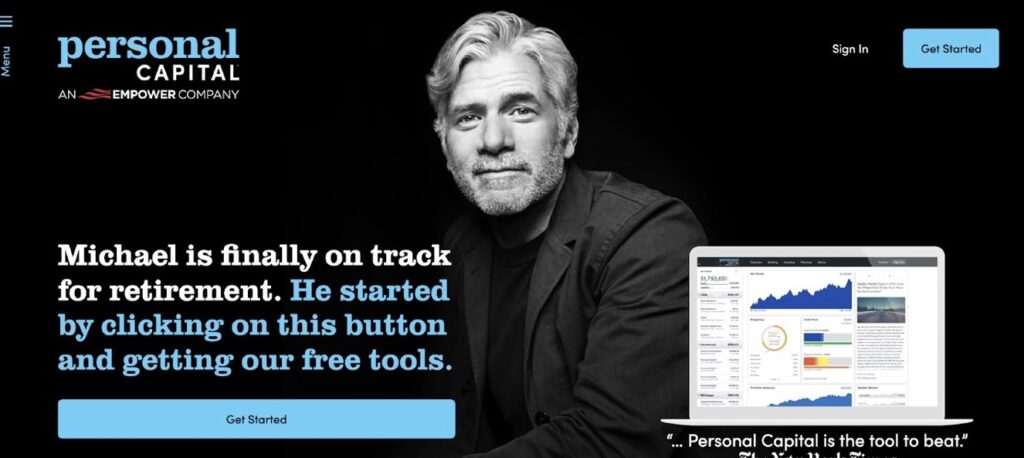

Personal Capital: Hands-On Retirement Planning and More for Wealthy Investors

For affluent individuals seeking hands-on retirement planning and comprehensive wealth management, Personal Capital offers a suite of sophisticated tools and services. Discover how Personal Capital can elevate your financial strategies and optimize your wealth management endeavors.

About Personal Capital

Personal Capital’s focus on personalized wealth management sets it apart, catering to the specific needs of high-net-worth individuals. The platform’s retirement planning tools, investment tracking, and financial advisory services are tailored to provide a bespoke experience for affluent clients.

| Key Features of Personal Capital |

|---|

| – Personalized Wealth Management |

| – Retirement Planning Tools |

| – Financial Advisory Services |

Embark on a journey towards optimized wealth management by leveraging the tailored solutions offered by Personal Capital.

YNAB: A Budgeting App That Puts Users in Control of Their Cash

You Need a Budget (YNAB) is a budgeting app designed to empower users by putting them in control of their finances. Explore the unique features and functionalities of YNAB to understand how it can revolutionize the way you manage your money.

About YNAB

YNAB’s proactive approach to budgeting encourages users to take charge of their cash flow, prioritize spending, and work toward financial stability. The app’s intuitive interface and educational resources make it an invaluable tool for individuals looking to achieve financial freedom.

| Key Features of YNAB |

|---|

| – Proactive Budgeting Approach |

| – Intuitive Interface |

| – Educational Resources |

Take the first step towards financial empowerment by embracing YNAB’s proactive budgeting approach and intuitive resources.

Conclusion

In conclusion, the landscape of money management, investment tracking, and budgeting apps offers a diverse range of solutions to cater to various financial needs. Whether you’re a modern investor seeking comprehensive asset tracking with Kubera, an individual or business looking for holistic financial management with Quicken, or an affluent client in need of personalized wealth management with Personal Capital, there’s a platform tailored to address your specific requirements. By understanding the key features and unique offerings of each platform, you can make an informed decision to propel your financial journey toward success.

+ There are no comments

Add yours