In the fast-evolving landscape of cryptocurrency investments, keeping a close watch on the ever-fluctuating values of diverse assets is paramount. This comprehensive guide delves into the realm of Cryptocurrency Return on Investment (ROI), unraveling its calculation intricacies, and introduces Internal Rate of Return (IRR) as a sophisticated metric.

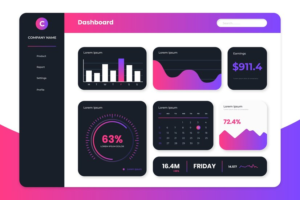

Discover how Kubera, an advanced wealth-tracking app, provides a streamlined approach to assess and optimize investment portfolios, all while focusing on the main SEO key, Crypto ROI and IRR.

What Distinguishes Crypto ROI?

Return on Investment (ROI) serves as a pivotal metric, evaluating an asset’s current value against its initial cost. This principle is particularly significant in the domains of Bitcoin, Ethereum, and various altcoins, offering investors insights into their investment performance.

A positive ROI signifies an asset’s upward trajectory, while a negative value indicates a decline. Formula in Action:

Initial value

ROI= Present value−Initial value×100

Example:

Suppose an investment of $10,000 in Bitcoin has grown to $40,000. The ROI would be (10,00040 000−10,000)×100=300%.

Why Measure Crypto ROI?

Efficiently managing a crypto portfolio requires a keen understanding of ROI, acting as a compass for decisions on retention, sale, or exploring alternative investments.

Strategic Investments

Determining the cash flow generated by an investment is integral to making informed choices for portfolio expansion. Positive cash flow is instrumental in fueling new investments.

Navigating the Pitfalls of Crypto ROI: Risk Oversights

Despite its utility, Crypto ROI has inherent limitations, notably its inability to account for the risk associated with an investment. Prudent investors recognize the need for a holistic risk assessment.

Expense Blind Spots

The ROI formula falls short in incorporating ongoing expenses, such as transaction fees in the crypto domain. Unforeseen costs can skew ROI projections, making it challenging to assess an asset’s true performance.

Temporal Considerations

Time, a crucial dimension in investment, often remains unacknowledged in traditional ROI calculations. A significant appreciation over a decade differs substantially from a rapid surge within a year.

Introducing IRR – A Holistic Approach

Internal Rate of Return (IRR), a nuanced metric, factors in annual growth rates and cash flows in and out of an investment. Unlike ROI, IRR acknowledges the temporal element, making it a comprehensive tool for gauging asset performance.

Kubera – Simplifying IRR Computation

Enter Kubera, a holistic wealth-tracking application accommodating traditional and digital assets. Kubera introduces an automated IRR calculator, streamlining the assessment of an asset’s performance.

Benchmarking Performance

Kubera empowers users to benchmark an asset’s IRR against prominent indices and tickers. This feature aids in evaluating an investment’s performance relative to industry standards.

Conclusion

In the dynamic realm of cryptocurrency investments, understanding asset performance is crucial. While Crypto ROI is fundamental, its limitations call for a more sophisticated approach.

Internal Rate of Return (IRR) steps in, and with Kubera’s innovative features, investors can simplify complex calculations and gain a holistic view of their portfolios. As the crypto landscape evolves, leveraging such tools becomes essential for informed decision-making and portfolio optimization.

+ There are no comments

Add yours